Investing correctly with investment funds

From Prof. Dr. Peter SpettenhuberProfessorship for Accounting and Auditing at the Allensbach University

Until the very end, households hoarded the money they had produced in large quantities since 2008, thereby protecting themselves and other economic players from the negative consequences of inflation. They forwent income from interest and dividends and even accepted storage costs in the form of negative interest rates and custody fees. However, the hoards were always threatened by the bursting of a "money bubble". With rising inflation rates, storing value in non-interest-bearing or low-interest-bearing nominal values has largely lost its meaning.

Investment funds offer an increasingly popular way out of real devaluation. Depending on the concept, these open up acceptable combinations of return and risk, even for smaller commitments The taxation of funds was fundamentally changed by the Investment Tax Reform Act (Investmentsteuerreformgesetz - InvStG) of 19 July 2016 with effect from 1 January 2018. Until then, taxation was based on a semi-transparent system directly with the investor. Taxation now takes place both at fund level and at investor level. For this reason, there is a partial exemption at investor level, as taxation has already taken place at fund level.

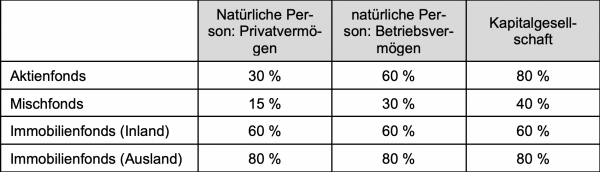

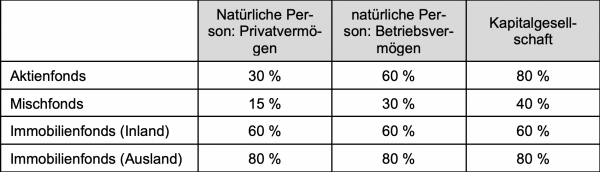

Of particular interest are the exemption rates, which vary depending on the type of fund and the quality of the investor, Section 20 InvStG.

Choosing the right structure

The different exemption rates make it a real challenge to structure the invested assets sensibly.

Private assets vs. business assets?

If the investor is also an entrepreneur, he is faced with the question of whether to acquire fund units with available funds from the business and leave the units as business assets, or whether to withdraw funds first and acquire the units as private assets. As the withdrawal of liquid funds does not generally trigger any tax consequences, the decision can be made solely on the basis of the tax burden on the income.

To take advantage of the higher exemption rate, an entrepreneur could transfer funds from private assets to business assets and invest them there. As the contribution and subsequent withdrawal of liquid assets also have no income tax consequences, the current tax burden is also the only decisive factor in this decision. Investors who are not yet entrepreneurs are not denied these arrangements. By founding a commercial GmbH & Co. KG, they can create business assets for tax purposes and use them for the investment. However, the costs of setting up and ongoing administration of such a company must be taken into account when determining the after-tax return.

Corporation: inside or outside?

Shareholders in a corporation can decide whether the fund units are acquired by the company or by themselves. Here too, non-shareholders can create such an option for themselves at short notice. There are no longer any major obstacles to setting up an asset management GmbH. The administrative costs for the formation and ongoing maintenance of the company must again be taken into account when assessing the benefits.

Taxation of income from an investment fund

What is taxed?

The InvStG recognizes three types of income that are subject to taxation for the participant. These are according to § 16 InvStG:

- Distributions

- Advance flat rates

- Capital gains

Distributions are made when the fund pays out amounts to the investor. Capital gains are realized when investors dispose of their units against payment. The advance lump sum appears somewhat more complex. This is incurred if the fund achieves an increase in value that is not distributed. Three factors are important for calculating the advance lump sum: the base interest rate, the base return and the increase in value of the fund.

The upfront lump sum can currently be disregarded. Because the German Bundesbank has calculated a negative prime rate of 0.45 % for 2021, the up-front lump sum no longer applies. And unless the ECB makes a decisive change to its monetary policy, this will remain the case.

How is taxed?

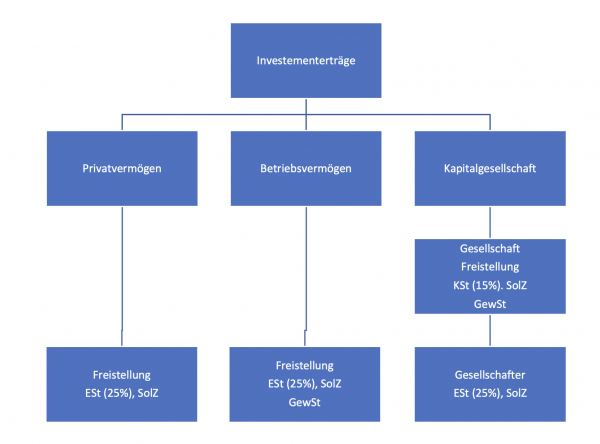

The aforementioned income is taxed differently for the three selected structures. Income from private assets is generally subject to the linear flat-rate withholding tax of 25 % after the partial exemption. The solidarity surcharge (SolZ) is always added to this. If the investor's individual income tax rate is lower than 25 %, taxation can be carried out at the lower rate. In this case, the solidarity surcharge may also be waived.

Income from business assets is subject to income tax and solidarity surcharge, as well as trade tax. In the case of trade tax, only half of the exemption rates apply. For (partial) relief, trade tax can be offset against income tax in accordance with § 35 EStG. If the investment is made within a corporation, the income is initially subject to corporation tax of 15 % plus solidarity surcharge and trade tax at the level of the company. Trade tax cannot be offset against corporation tax for corporations. If the funds released from the investment are distributed to the investor, a final withholding tax of 25 % plus solidarity surcharge is payable at shareholder level. Taxation at the lower individual tax rate is also possible here. In this case, the solidarity surcharge may also be waived.

Benefit calculations

Framework data

To anticipate this: It is not possible to make a generally valid statement about the benefits. Therefore, calculations should always be made before making a decision. The calculations always require Type of fund, individual tax rate and trade tax multiplier. The following may also be required: Investment duration and investment return. The following calculations apply to an equity fund. The individual tax rate was assumed to be 42 % and the trade tax multiplier was assumed to be 400 %.

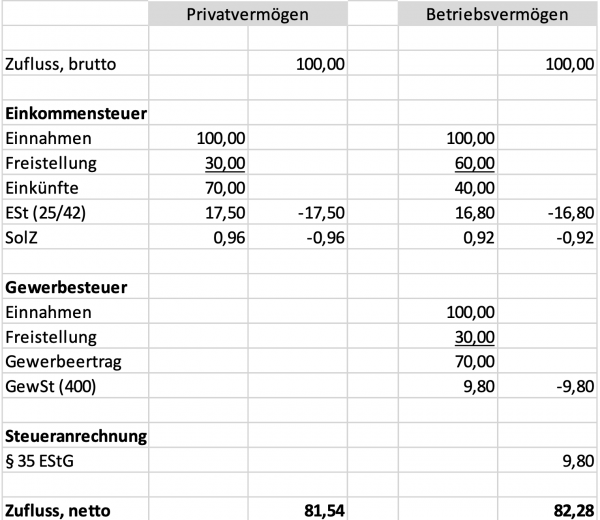

Comparison: private assets or business assets

This comparison can be made solely on the basis of the individual income tax rate and the trade tax multiplier, irrespective of the investment period and return. In the case of an investment in private assets, the income generated is exempt at 30 %. They are then subject to capital gains tax of 25 % plus solidarity surcharge. With gross income of 100, the investor is left with a net amount of 81.54.

If investments are made in business assets, a partial exemption of 60 % for income tax and 30 % for trade tax can be used. The income is subject to income tax at the individual rate (here 42 %), solidarity surcharge and trade tax (here: assessment rate 400 %). In accordance with § 35 EStG, trade tax can be fully credited against income tax. In the example case, the investor is left with a net amount of 82.28. Despite the high individual income tax rate and despite the formal trade tax burden, the investment in business assets is preferable.

Comparison: inside or outside the corporation

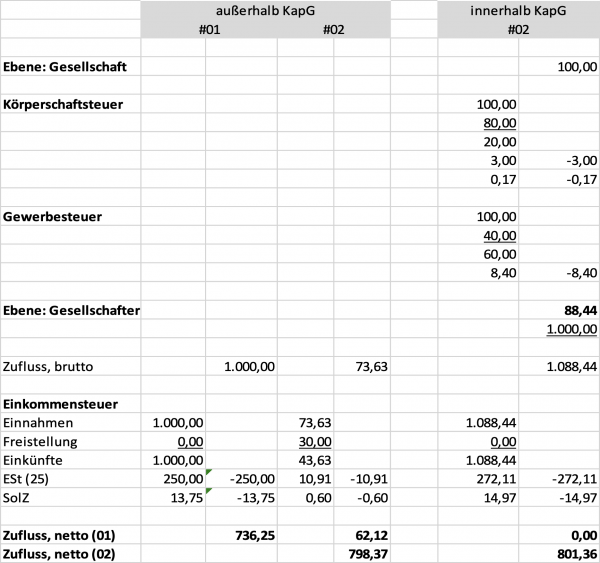

The question here is whether the corporation should pay out immediately and the investor should invest in the private assets or whether the corporation should invest and then pay out. The comparison is therefore also dependent on the investment period and return. The example was calculated with an investment period of one year and a return of 10 %.

If the investment is made outside the corporation, the distribution to the investor is subject to a capital gains tax of 25 % plus solidarity surcharge. If funds of 1,000 were available at the level of the company, the shareholder is left with an investment amount of 736.25. With a return of 10 %, the investor receives a gross amount of 73.63 in the following year or a net amount of 62.12 after deduction of income tax (25%) and solidarity surcharge. At the end of the second year, the investor therefore has assets of 798.37.

In contrast, the investment within the corporation proves to be advantageous. The company can initially invest an amount of 1,000 and receive a gross income of 100. After deduction of corporation tax, solidarity surcharge and trade tax, the net income is 88.44. The company can distribute 1,088.44 to the shareholder. The distribution is subject to capital gains tax (25%) and solidarity surcharge for the shareholder. In total, the shareholder then has funds of 801.36, which is more than in the alternative arrangement outside the company.

Result

The interposition of business assets or a corporation can therefore be advantageous. The different exemption rates thus support an economic policy that aims to promote the equity ratio of companies. However, as is so often the case in tax law, it is not possible for investors to make a general statement. Instead, precise calculations must be made for each individual case. However, this calculation work can pay off, in the truest sense of the word.